Business Valuation Services

Business Valuation Services at Perpetual Wealth Planning

At Perpetual Wealth Planning, we understand that accurate business valuation is a cornerstone of strategic decision-making for owners, investors, and stakeholders. Our Business Valuation services provide comprehensive and precise assessments of business worth using industry-standard methodologies, ensuring that our clients have the insights they need to make informed financial and operational decisions.

Expert Valuation Methodologies

Our certified valuation professionals employ multiple valuation approaches to ensure thorough and defensible valuations. These methodologies include:

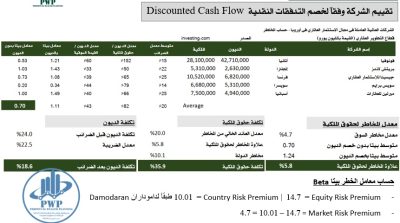

- Income Approach: Utilizing detailed Discounted Cash Flow (DCF) calculations, we assess the present value of future cash flows, incorporating revenue growth projections, margin trends, and capital expenditure requirements.

- Market Approach: Conducting comparable company analysis and evaluating transaction multiples, we benchmark businesses against industry peers to determine fair market value.

- Asset-Based Approach: Analyzing tangible and intangible assets, we provide valuations based on the company’s net asset value, ensuring a holistic assessment of financial health.

Our team develops sophisticated financial models that incorporate short-term forecasts spanning 1-3 years and long-term projections extending 5-10 years. These models analyze working capital needs, investment strategies, and liquidity considerations, creating realistic cash flow scenarios that support sustainable business growth.

Comprehensive Valuation Services

Our valuation expertise extends across various financial and strategic needs, including:

- Mergers and Acquisitions (M&A): Assisting businesses in determining fair market value for acquisitions, divestitures, and strategic partnerships.

- Estate Planning and Gift Tax Purposes: Providing valuations that support wealth transfer strategies and tax compliance.

- Shareholder Disputes: Delivering objective valuations to resolve ownership conflicts and equity distribution matters.

- Buy-Sell Agreements: Establishing valuation benchmarks for ownership transitions and business succession planning.

- Financial Reporting Compliance: Ensuring valuations meet regulatory standards for accounting and financial disclosures.

- Strategic Planning Initiatives: Supporting businesses in long-term financial planning and investment decision-making.

Tailored Valuation Reports for Critical Business Decisions

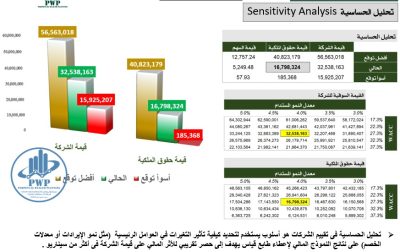

Whether you are preparing for a business sale, establishing employee stock ownership plans (ESOPs), resolving partnership disagreements, or conducting periodic business health assessments, our valuation reports provide comprehensive market analysis, risk assessments, sensitivity testing, and clear explanations of methodologies and assumptions.

Our reports are designed to be objective, well-documented, and defensible, ensuring they stand up to scrutiny from buyers, sellers, attorneys, accountants, and regulatory authorities. We go beyond standard valuation metrics by incorporating industry trends, competitive positioning, and financial risk factors, offering actionable insights that enhance business value over time.

Commitment to Excellence and Client Success

At Perpetual Wealth Planning, we pride ourselves on delivering high-quality valuation services that empower businesses to make strategic financial decisions with confidence. Our team is committed to accuracy, transparency, and integrity, ensuring that every valuation report is tailored to the unique needs of our clients.

By leveraging advanced financial modeling techniques, industry expertise, and rigorous analytical frameworks, we provide valuations that serve as a foundation for growth, investment, and long-term success.

If you are seeking expert business valuation services that provide clarity, precision, and strategic insights, Perpetual Wealth Planning is your trusted partner in financial excellence.