Real Estate Financial Modeling

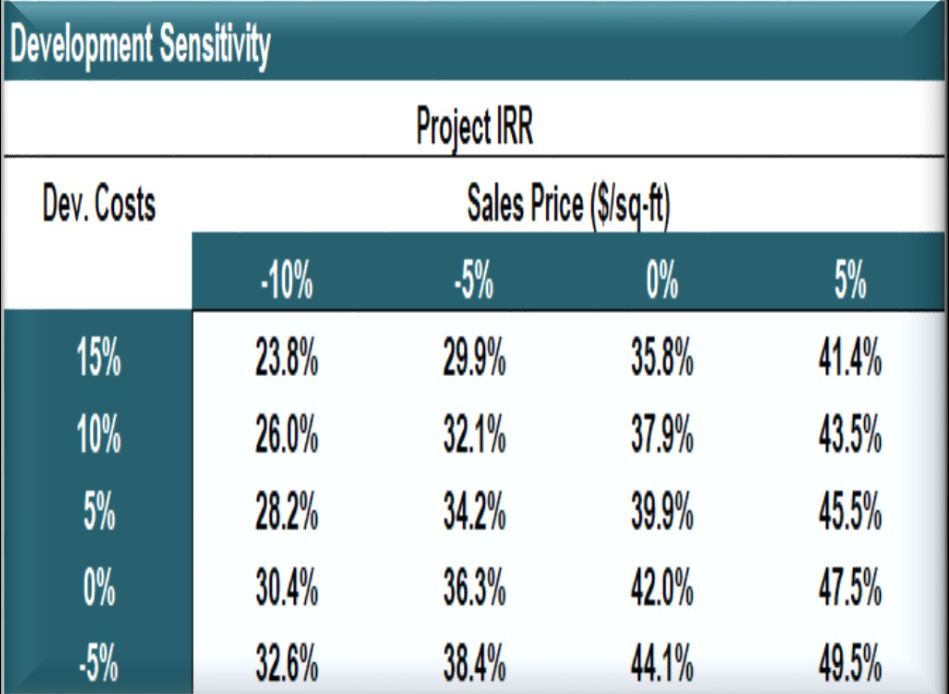

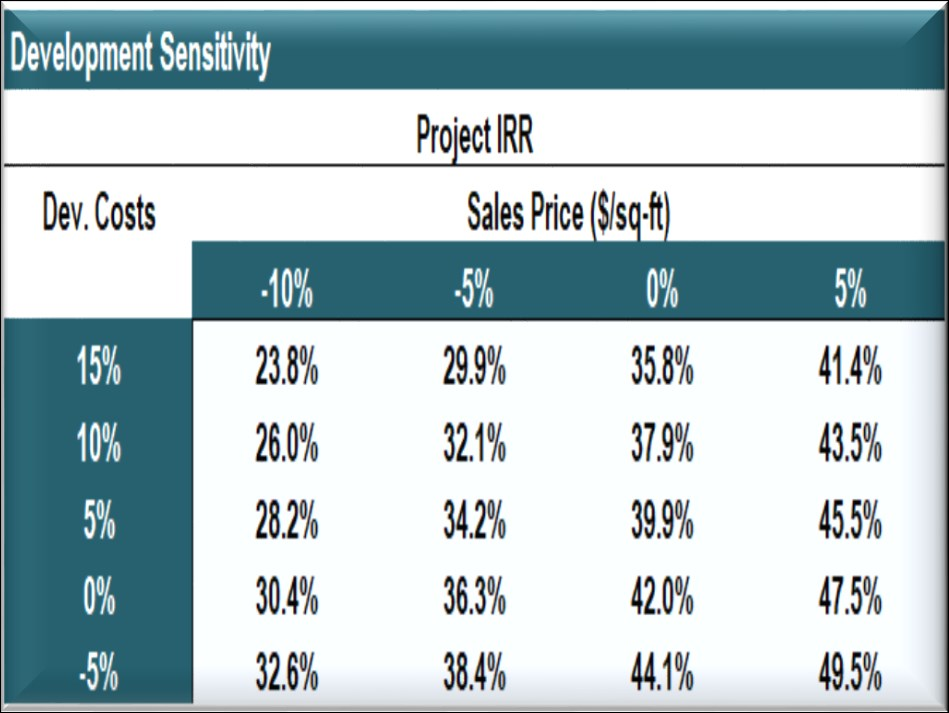

At Perpetual Wealth Planning, our Real Estate Financial Modelling services provide developers, investors, and property professionals with sophisticated analytical tools to evaluate investment opportunities, optimize project returns, and make informed real estate decisions across all property types. Our comprehensive modeling capabilities include detailed unit sales price calculations based on market comparable, absorption rate analysis, construction cost escalation projections, and revenue optimization strategies for residential, commercial, and mixed-use developments. We develop advanced financial models incorporating acquisition analysis, development feasibility studies, cash flow projections, financing structure optimization, and sensitivity analysis to assess various market scenarios and risk factors. Our services encompass pre-development feasibility assessments, construction financing models, sales and marketing budget planning, profit margin analysis, and exit strategy evaluations that help clients maximize returns while minimizing exposure to market volatility.

Whether you’re evaluating a single-family residential project, multi-unit apartment complex, commercial office development, or retail center investment, our detailed financial models provide unit-by-unit pricing strategies, phased release schedules, market positioning analysis, and comprehensive pro-formas that account for all development costs, financing expenses, and projected revenues. Our real estate modeling expertise enables clients to secure financing, attract investors, negotiate partnerships, and execute successful projects with confidence in their financial projections and market assumptions.