Business Valuation

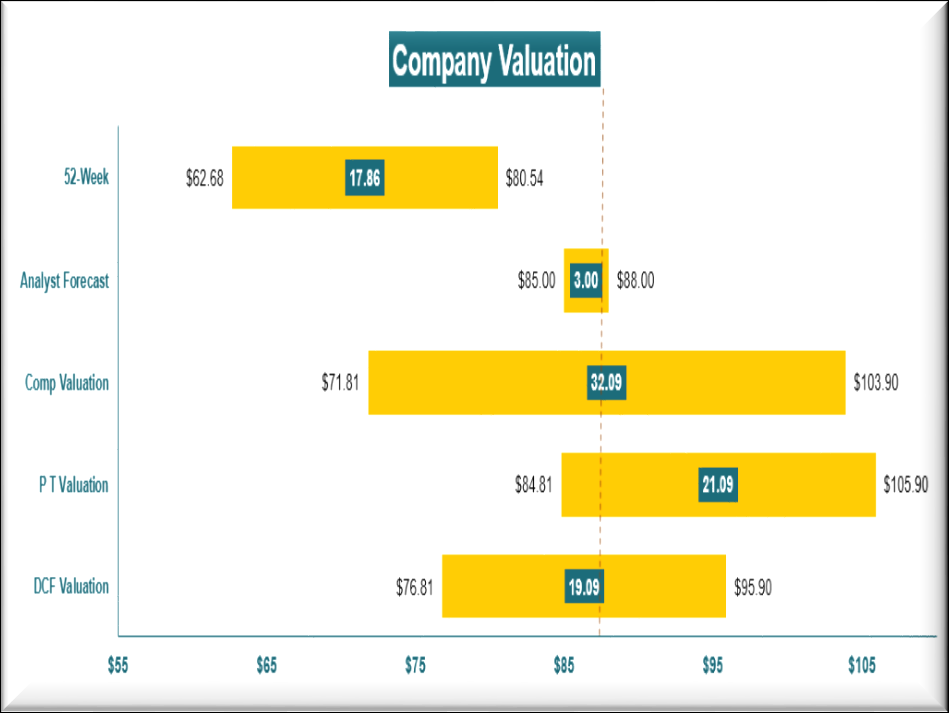

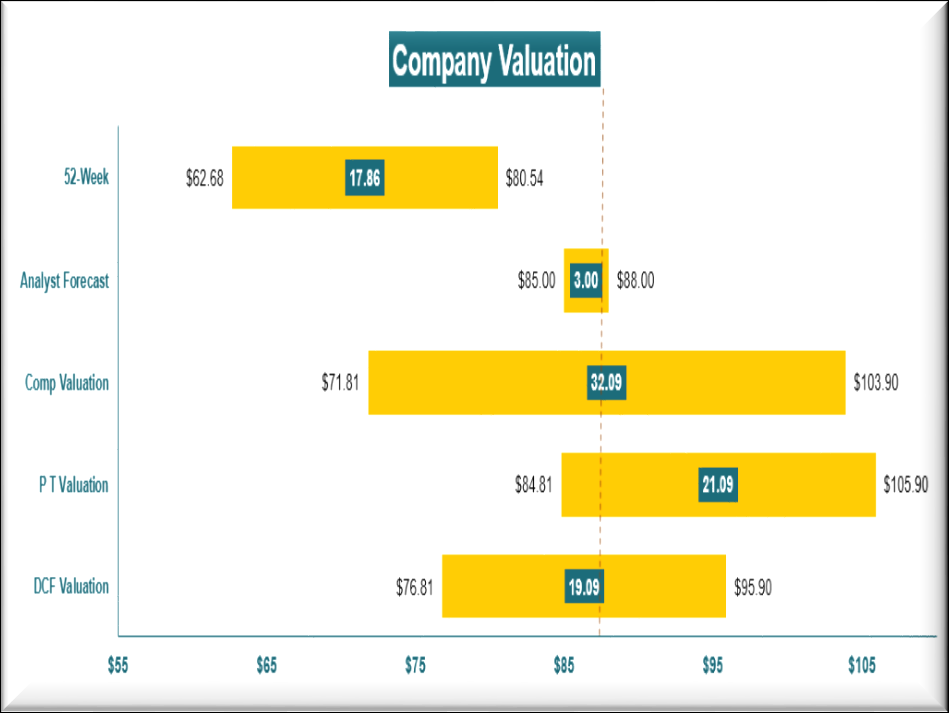

At Perpetual Wealth Planning, our Business Valuation services provide comprehensive and accurate assessments of business worth using industry-standard methodologies to support critical decision-making for owners, investors, and stakeholders. Our certified valuation professionals employ multiple valuation approaches including the income approach with detailed Discounted Cash Flow (DCF) calculations, market approach utilizing comparable company analysis and transaction multiples, and asset-based approaches to ensure thorough and defensible valuations. We develop sophisticated financial models incorporating short-term forecasts spanning 1-3 years and long-term projections extending 5-10 years, analyzing revenue growth patterns, margin trends, capital expenditure requirements, and working capital needs to create realistic cash flow scenarios. Our services encompass valuations for mergers and acquisitions, estate planning and gift tax purposes, shareholder disputes, buy-sell agreements, financial reporting compliance, and strategic planning initiatives. Whether you’re preparing for a business sale, establishing employee stock ownership plans, resolving partnership disagreements, or conducting periodic business health assessments, our detailed valuation reports include comprehensive market analysis, risk assessments, sensitivity testing, and clear explanations of methodologies and assumptions. We pride ourselves on delivering objective, well-documented valuations that stand up to scrutiny from buyers, sellers, attorneys, accountants, and regulatory authorities while providing actionable insights to enhance business value over time.